How to master your finances: 8 Steps of Budgeting Process

Unlock Financial Success: The 8 Steps of Budgeting Process is a vital skill for controlling your financial future. Budgeting is a cornerstone of successful financial management, guiding you toward your goals and optimizing your money. Many individuals aged 40+ are preparing to retire or are already retired which means they are on a fixed budget. Therefore it’s important to have control of your finances. In this in-depth guide, we’ll explore each of the eight steps of budgeting process, providing you with a comprehensive understanding of how to create a budget that aligns with your goals and aspirations.

What is a budget and the budgeting process?

A budget is a roadmap that guides you towards your financial goals and the budgeting process helps you keep track of your spending by ensuring that your money is working for you. In layman terms, a budget is a plan for how you’re going to spend your money. You need to give every dollar you earn a name, i.e., a purpose. Financial guru, Dave Ramsey often says “a budget is telling your money where to go instead of wondering where it went.”

Why is a budget Important?

A budget is a financial plan that outlines your income and expenses. It’s essential because it helps you manage your money, achieve financial goals, and make informed financial decisions, which is the first step in managing it effectively.

What role does Budgeting play in our personal finances?

Budgeting should play a central role in managing our personal finances. It’s hard to be financially savvy without having a budget or some form of tracking. Not tracking your spending can put you in a difficult financial situation which could result in unnecessary stress, fees, and debt.

What are the benefits of budgeting?

Some benefits of budgeting are financial control, expense tracking, goal setting, debt management, emergency preparedness, wealth building, financial awareness, reduced financial stress, adaptability, expense prioritization, and goal achievement.

Some additional benefits are an improved credit score, financial discipline, better decision making, increased savings rate, helps with retirement and tax planning, financial transparency, reduced financial waste, long-term financial security, improved financial relationships, increased confidence, lifestyle adjustment, and legacy planning.

What is the most difficult part of budgeting?

The most difficult part of budgeting is subjective. It can vary from person to person and often depends on individual circumstances, financial goals, and personal habits. Some common challenges people face when budgeting include:

Expense Tracking – It can be challenging to track every dollar that comes in and goes out of the budget. It takes discipline to track expenses, but with some hard work and determination it can be achieved.

Sticking To A Budget – Creating a budget is easy but sticking to it can be tough. Especially for people who are spenders and don’t like to feel restrained. Temptations and unexpected expenses can make it challenging to adhere to the spending plan.

Unexpected Expenses – Life can throw a curve ball at any minute. Unexpected expenses like medical bills, car repairs, or home maintenance can disrupt even the best budgeting plans. A solution for unexpected expenses is to save for an emergency fund or create a sinking fund and budgeting can help you to do both.

Changing Financial Situation – Significant changes in income or a job loss can prove to be a challenge to adjust the budget accordingly.

Dealing With Debt – People may find it difficult to stick to a budget when they are buried in mountains of debt.

Balance Priorities – It can be hard to strike a balance when trying to allocate funds to various categories such as investing, debt reduction, saving, and current expenditures.

Lifestyle Adjustments – Some individuals view budgeting as a confinement especially if it requires them to have to adjust their lifestyle by cutting back on dining out or entertainment, it can be challenging to adapt to these changes.

Budget Fatigue – Some people experience budget fatigue over time, feeling overwhelmed by the continuous monitoring of expenses and sticking to a financial plan.

Lack of Motivation – Planning forecasting and budgeting can seem overwhelming. Maintaining motivation to budget and save can be challenging, especially if your financial goals are long-term and seem distant.

Lack of Financial Literacy – For those who are not well-versed in personal finance, understanding financial terms, investment options, and tax implications can be challenging.

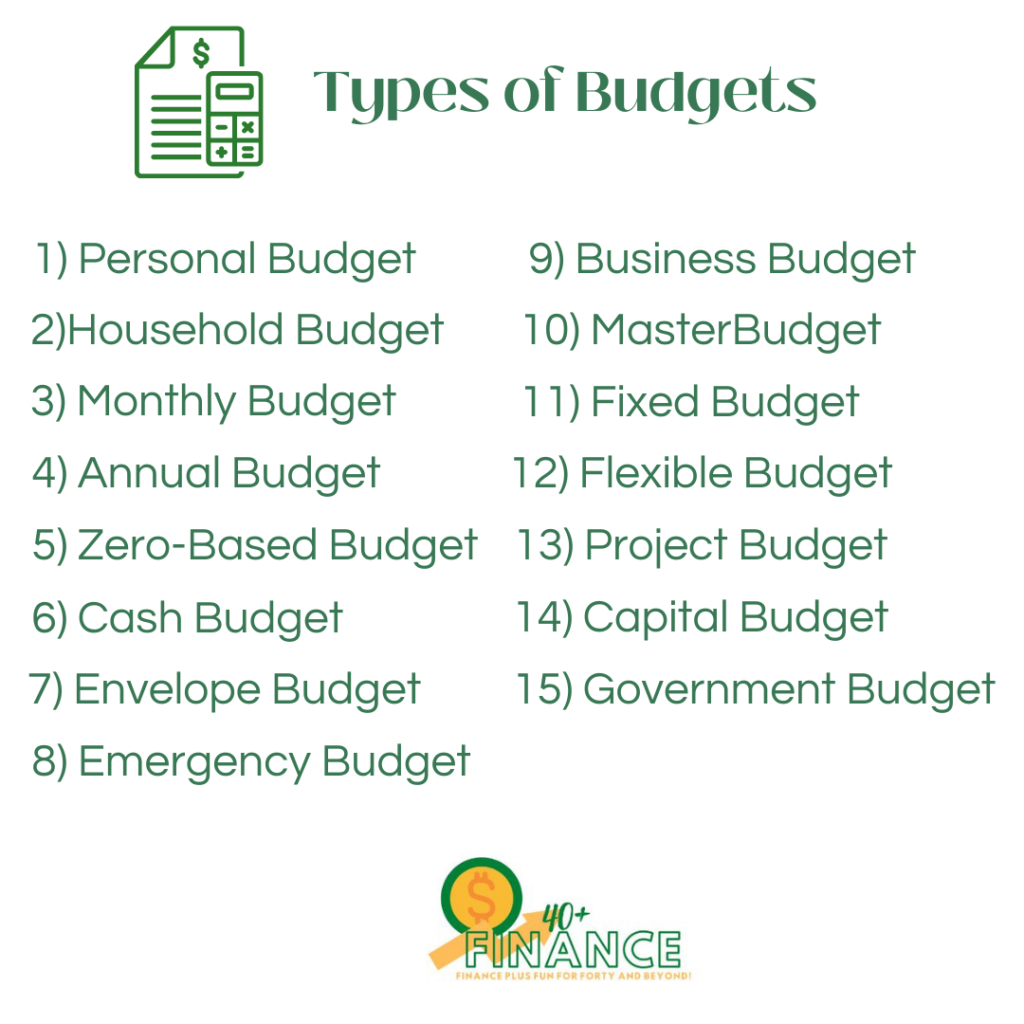

What are the different types of budgets?

Some of the different types of budgets are personal budget, household budget, monthly budget, annual budget, zero-based budget, cash budget, envelope budget, emergency budget, business budget, master budget, fixed budget, flexible budget, project budget, capital budget, and government budget.

The most common budgets for personal finance are personal budget, zero-based budget, or envelope budget.

My personal favorite is a combination of all 3 budgets listed above with the zero-based budget being the foundation of the budget.

What is a zero-based budget and is zero-based budgeting good?

In a zero-based budget, every dollar of income is allocated to a specific expense or savings category. At the end of the budgeting period, the goal is to have a balance of zero, meaning all income has been allocated.

Zero-based budgeting can be highly effective if done correctly but that depends on your financial goals, spending habits, and the level of detail you’re willing to commit to in your budgeting process.

What are the advantages of zero-based budgeting?

Some of the advantages of Zero-based budgeting are:

Every Dollar Has A Purpose – Every dollar has a purpose and is allocated to a specific expense or saving category. This level of control can help prevent overspending.

Focus on Priorities – Zero-based budgeting forces you to prioritize your spending. You allocated funds to what matters most, which can align your spending with your financial goals.

Expense Review – Zero-based budgeting requires you to review and justify all expenses regularly. This can help identify unnecessary or wasteful spending.

Reduced Unplanned Spending – Since you allocate funds intentionally, there’s less room for impulsive or unplanned purchases.

Increase Savings – Zero-based budgeting often emphasizes saving and investing. It encourages you to allocate funds to savings goals consistently.

Once you have determined what type of budget is more appropriate for your situation then it’s time to implement the process 8 steps.

Here are the 8 steps of Budgeting process

- Step 1 – Set clear financial goals

- Step 2 – Assess your current financial situation

- Step 3 – Categorize your expenses

- Step 4 – Create a budget framework

- Step 5 – Track your spending

- Step 6 – Identify areas for improvement

- Step 7 – Adjust and fine-tune

- Step 8 – Review and reflect

Let’s take a closer look at each one

Step 1: Set Clear Financial Goals

The budget process begins with a clear understanding of your financial goals. These goals act as the driving force behind your budget, motivating you to manage your money effectively. Start by defining both short-term and long-term objectives. Whether it’s paying off debt, saving for a down payment on a house, or preparing for retirement, make your goals Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). This strategic plan or approach ensures that your goals are realistic and attainable.

Step 2: Assess Your Current Financial Situation

To create an effective budget, you must have a comprehensive understanding of your current financial situation. Begin by gathering all relevant financial information, including your sources of income, outstanding debts, regular expenses, and savings. Review your bank statements, credit card bills, and any other financial documents to ensure accuracy.

Step 3: Categorize Your Expenses

Organizing your expenses into categories is essential for understanding your spending habits. Common categories include housing, transportation, groceries, utilities, entertainment, and debt payments. Categorization allows you to visualize where your money is going and helps you identify areas where you might need to cut back or adjust your spending.

Step 4: Create a Budget Framework

Using the information you’ve gathered, create a budget framework. Start by listing your sources of income, such as your salary, side gig earnings, or rental income. Next, allocate a specific amount to each expense category based on your financial goals and priorities. Allocate funds for necessities like housing and groceries, discretionary spending like dining out or entertainment, and savings for your future.

Step 5: Track Your Spending

Once your budget is in place, it’s essential to track your actual spending to ensure that you’re staying on track. Use budgeting tools, apps, or spreadsheets to record each transaction. Regularly review your spending against your budget to identify any discrepancies or areas where you might be overspending.

Some popular budgeting tools or apps are:

- Every Dollar

- YNAB

- Mint

- Goodbudget

- Simplifi by Quicken

- Pocket Guard

- Empower Personal Wealth

- Honeydue

- Fudget

Step 6: Identify Areas for Improvement

Tracking your spending allows you to identify areas where you can cut costs or make adjustments. Analyze your spending patterns to find opportunities for savings. This might involve reducing discretionary expenses or finding more cost-effective alternatives for certain purchases. Identifying areas for improvement is a crucial step in creating a budget that aligns with your financial goals.

Step 7: Adjust and Fine-Tune

As you continue to track your spending and identify areas for improvement, be prepared to adjust and fine-tune your budget. Life is dynamic, and unexpected expenses or changes in priorities can impact your financial situation. A flexible budget allows you to accommodate these changes without derailing your financial goals.

Step 8: Review and Reflect

Regularly review the 8 steps of budgeting process to assess your progress toward your financial goals. Reflect on your achievements and any challenges you’ve encountered. This review process helps you stay accountable and motivated. If you’re consistently meeting your goals, consider revising them to make them more ambitious. If challenges arise, troubleshoot, and adjust your budget accordingly.

Final Thoughts

Mastering the 8 steps of budgeting process is a powerful tool that empowers you to take control of your financial journey. By following these eight comprehensive steps, you’ll not only gain clarity on your financial goals and priorities but also develop a practical plan to achieve them. Remember, budgeting is not a one-time activity; it’s an ongoing process that evolves as your financial situation and goals change. Embrace the power of budgeting, and watch as your financial well-being transforms, opening opportunities for a secure and prosperous future.

FAQs

-

How do I start budgeting if I’ve never done it before?

Begin by setting clear financial goals, assessing your current financial situation, and categorizing your expenses. Follow the eight steps outlined in the article to create a budget.

-

What are SMART financial goals?

SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. They help you define clear and actionable objectives for your budget.

-

How often should I review and adjust my budget?

Regularly review your budget, ideally monthly. Adjust it when your financial situation changes, or when you encounter unexpected expenses.

-

What are some common budgeting pitfalls to avoid?

Common pitfalls include underestimating expenses, not accounting for irregular expenses, and failing to track spending. The article provides tips on avoiding these pitfalls.

-

How can I stick to my budget and avoid overspending?

To stay on track, monitor your spending, prioritize needs over wants, and consider using budgeting tools or apps. Make sure to adjust your budget as needed.

-

Is it possible to budget and save money even with a limited income?

Yes, budgeting is beneficial regardless of your income level. It helps you make the most of your available resources and can lead to significant savings over time.

-

Can budgeting help me pay off debt faster?

Absolutely. Budgeting allows you to allocate more money toward debt payments, helping you pay off debts more efficiently.

-

What’s the role of an emergency fund in budgeting?

An emergency fund is a critical part of a budget as it provides a financial safety net. It helps cover unexpected expenses without derailing your budget.